Pranav Kumar Convictions based on circumstantial evidence are not uncommon. However, there seems to be an adjudicatory difference in the treatment accorded to such evidence by the judges. This article attempts to study such differences and rationalise it. To that end, it shows that despite the Courts explicitly declaring parity between circumstantial and direct evidence Continue reading

Read MoreVedant Saxena While it is true that fictional characters have not traditionally been considered as works of art separate from the work they originally appeared in, or as an indicator of origin, in light of a plethora of judgments over the years, the relevance of fictional characters has been recognized by courts and certain arenas Continue reading

Read MoreAshit Kumar Srivastava & Shaileshwar Yadav (On behalf of the Editorial Board)

Read MoreWe are pleased to announce the results of the 1st DNLU Student Law Journal Essay Writing Competition, 2023 organized in collaboration with Regstreet Law Advisors. The theme of the Competition was ‘Capital Markets and Securities Law’ and it was aimed at bringing together inquisitive luminaries of the legal field to explore the labyrinthine paths of Continue reading

Read MoreIntroduction The case of Shilpa Sailesh vs Varun Sreenivasan marks a significant milestone in the annals of Indian family law, heralding a paradigm shift in the judiciary’s approach to marital disputes and the dissolution of marriage. The case originated from a deeply contested matrimonial dispute between Shilpa Sailesh and Varun Sreenivasan, both parties embroiled in Continue reading

Read MoreOrganised by DNLU Student Law Journal, in collaboration with REGSTREET Law Advisors The deadline for the submission of the Essays is extended from 27th November 2023 to 15th December 2023. About the Competition The competition is an opportunity for legal enthusiasts to engage with the intricate dimensions of Capital Markets and Securities Laws. It aims to foster Continue reading

Read MoreAbstract We often hear disclaimers and cautions against going headfast into jobs that seem to show meagre growth potential and unstable security. But do these risks limit themselves to the initial period of job hunting? Or do they stretch to situations where one might have to forsake their earnings simply because their company can no longer Continue reading

Read Moreabstract The pre-approval stage of the resolution plan, which occurs before the NCLT accepts the plan, is a crucial stage and can make or break the entire resolution process. However, there is a lack of clarity regarding the tribunal’s power to intervene and adjudicate upon the issues arising at this stage, which has created uncertainty Continue reading

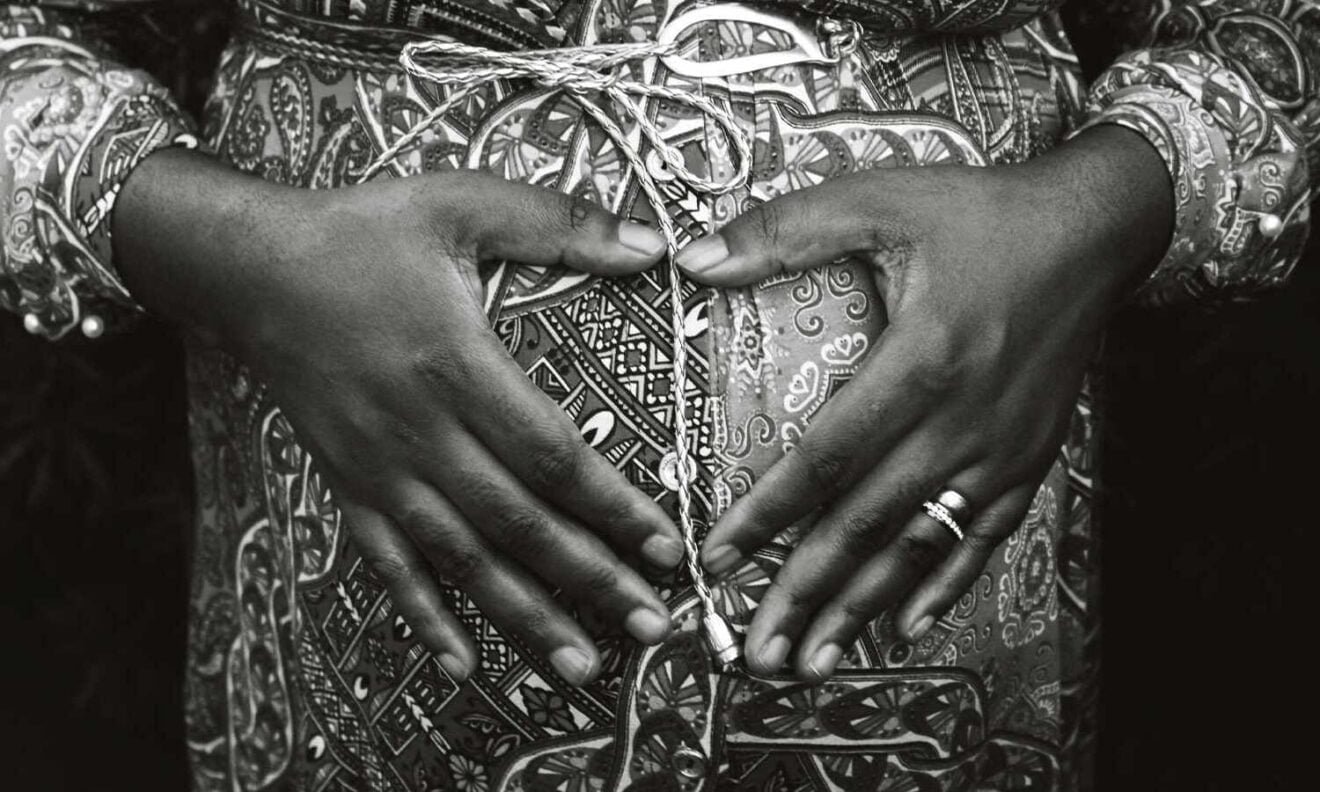

Read MoreAbstract The article reviews the legislative changes to the Medical Termination of Pregnancy Act 1971. It first provides background to the construction of the Act and proceeds to enumerate the various changes it has undergone. The author then elaborates upon the transformation and metamorphosis the Act has undergone to offer a critique of its various Continue reading

Read MoreAbstract The right against discrimination is bestowed by the Indian Constitution and given by people to themselves by respecting and creating a nation of equals. Revering this right, all institutions are urged to develop a gender-neutral and inclusive environment. Armed forces have long fallen back into their patriarchal seats, viewing, controlling, and regulating entry into Continue reading

Read More